SafeStake Newsletter – April 2025

Stake Smarter with SafeStake: DVT, Ethereum & the Road Ahead

Welcome to the April edition of the SafeStake Newsletter! As we enter a new quarter, optimism fills the Ethereum community—with the Pectra upgrade just around the corner and SafeStake gaining momentum as the most advanced DVT-based staking solution on mainnet. From protocol upgrades to major industry events, here’s everything you need to know about SafeStake and the evolving ETH staking ecosystem.

🔐 SafeStake: Mainnet Performance Exceeds Expectations

Since launching our public mainnet, SafeStake has proven itself as the most cost-efficient and high-performance staking infrastructure based on Distributed Validator Technology (DVT). Our operator network is showing outstanding results, consistently achieving over 99% performance, with validators successfully attesting every epoch and fulfilling their duties with precision.

This kind of reliability isn't luck—it's by design.

Source: SafeStake Dashboard

With SafeStake, your validator keys never leave your hands. They remain securely on your end, in a fully non-custodial setup. There’s no single point of failure, no centralised control. Just robust, secure, and decentralised staking.

And the best part?

Zero fees for your first three months.

🧠 Why SafeStake? Core Advantages at a Glance

1️⃣ Secure by Design

Your keys. Your control. Always.

100% non-custodial. Zero compromise.

2️⃣ Maximized Rewards, Minimal Risk

Validator operator committee ensures zero downtime.

No missed attestations. No penalties.

3️⃣ 20x Capital Efficiency

Run more validators using the same hardware.

Increase your yield without increasing your cost.

4️⃣ Decentralisation at Scale

SafeStake is now permissionless.

Help build a censorship-resistant Ethereum.

📡 Cluster Node in Action: A New Era for Solo Stakers

We’ve just released our Cluster Node Module Tutorial, demonstrating how to use the SafeStake cluster node to run Ethereum validators—securely and cost-effectively—without ever exposing your private key.

The module offers solo stakers and institutional players a compelling alternative to traditional solo setups, improving redundancy and resilience through DVT.

We’re actively inviting volunteers to test our cluster node. If you’re a validator or node operator interested in shaping the future of ETH staking, join our Discord and get involved.

🤝 SafeStake x Lido DAO: Collaboration in Progress

SafeStake continues to deepen its collaboration with Lido DAO, aiming to integrate with Lido’s Secure DVT Module and Cluster Service Module (CSM). In Q1, our team focused on testing compatibility, and in Q2 we’re counting on the community to support our integration via a governance vote.

Source: Lido DAO

A successful integration will allow Lido users to benefit from SafeStake’s secure, efficient validator infrastructure—powered by DVT—while advancing decentralisation at scale.

📈 The Institutional Wave Is Here

Since the inauguration of Trump in January 2025, institutional interest in Ethereum has surged. ETH-based investment products, especially staking-related ETFs, are gaining momentum, with the long-anticipated staked ETH ETF nearing approval.

Source: SEC

SafeStake is already preparing for this shift. In Q2, we’ll be launching our private DVT cluster module tailored for institutional clients. This will offer a plug-and-play solution for institutions looking to stake ETH at scale, with regulatory-grade security and operational flexibility.

🏛️ Ethereum: Upgrades, Optimism & Obstacles

The Ethereum ecosystem has had a dynamic month—balancing technological breakthroughs with competitive pressures and regulatory uncertainty.

🌟 Upcoming Upgrades

Pectra (May 7, 2025): Introduces EIP-7251, increasing the validator stake cap from 32 ETH to 2,048 ETH.

This is a major win for validator operators who previously had to manage multiple nodes. Now, fewer machines can handle more stake—improving efficiency and reducing complexity.

While EIP-7251 offers operational benefits for large staking operators, it raises valid concerns about potential centralization and the marginalization of solo stakers. For example, solo stakers, who typically stake 32 ETH per validator, might find themselves at a disadvantage compared to large operators who can now stake significantly more per validator. This disparity could lead to a less level playing field, where rewards and influence are skewed towards those with more substantial capital.

The Ethereum community continues to deliberate on these issues, balancing efficiency gains with the foundational principle of decentralization. Ongoing discussions and careful implementation will be crucial to address these concerns and maintain the network's integrity

Fusaka (Late 2025): Will implement EVM Object Format (EOF), targeting performance, scalability, and privacy.

The ultimate goal: 2,000 TPS and gas optimisations.

🧠 RISC-V on the Horizon?

Source: Ethereum Magicians

A bold proposal is circulating to replace the EVM with a RISC-V-based virtual machine—a move that could supercharge Ethereum’s scalability and efficiency.

Key implications for staking:

100x improvement in ZK-proof efficiency.

Optimised cryptographic operations for validator workloads.

Lower gas fees and faster contract execution—especially helpful for solo stakers.

This move could reshape how staking infrastructure like SafeStake interacts with Ethereum’s execution layer in the years to come.

⚠️ Challenges Ahead: ETH in the Crosshairs

Ethereum's momentum hasn’t come without challenges:

Regulatory delays: The SEC continues to stall on ETF approvals, affecting market sentiment.

Decreased network activity: Daily ETH burns hit historic lows—just 53 ETH burned on a recent day.

NFT volume down: Polygon has outpaced Ethereum in RWA-linked NFT sales.

Institutional competition: Other L1s and rollups are closing the gap in DeFi and performance.

However, Ethereum’s upcoming upgrades and community-led innovation (like SafeStake’s DVT model) point to a resilient future.

🏙️ SafeStake Takes Dubai: Staking Summit 2025

We’re proud to announce that SafeStake is a Gold Sponsor at this year’s Staking Summit in Dubai, the largest event of its kind in the world.

📅 April 28–29, 2025

📍 Dubai

🌍 Join us to meet leading protocols, validators, investors, and stakers from around the globe.

🎁 Stop by our booth for exclusive SafeStake gifts and insights into the future of staking.

SafeStake is more than a protocol—we’re a movement shaping the future of ETH staking.

👉 Secure your spot: stakingsummit.com

🧭 Staying True to Our Vision

If you’ve read our SafeStake 2025 Outlook, you already know—we’re delivering exactly what we promised:

✅ Strengthened validator performance

✅ Key collaborations with industry leaders

✅ Expanded educational content

✅ DVT made accessible for all

As Ethereum evolves, SafeStake remains your most reliable, secure, and scalable choice for staking.

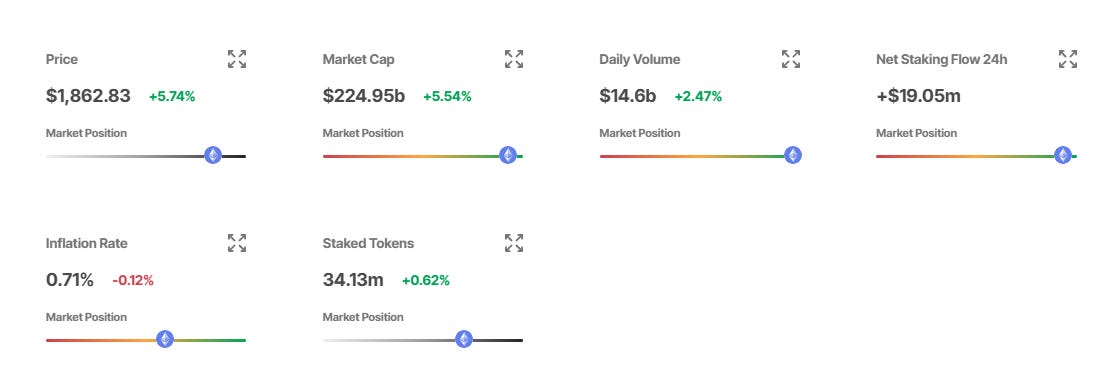

📊 Ethereum & SafeStake by the Numbers

Ethereum's staking ecosystem keeps evolving—and SafeStake is at the heart of that growth. Here's a breakdown of key data points to help you understand where the network stands and why SafeStake is strategically positioned for what's next:

🔹 ETH staking on the rise

As of April 2025, 28.27% of all ETH is staked, nearing the 30% mark—a trend that could reduce market liquidity and increase volatility.

Total ETH staked: 34.2 million ETH, with an average annual reward rate of 2.98% APR (excluding MEV).

Source: Staking Rewards

🔹 Liquid staking & restaking expansion

Lido leads the market with 9.7 million ETH staked, equivalent to $17 billion.

The restaking market has seen massive growth, reaching $16 billion in TVL by the end of April 2025, according to DefiLlama.

This signals growing institutional interest and widespread adoption of advanced staking solutions like SafeStake.

🔹 Validator growth & forward-looking projections

Active validators now total 1.07 million, up 9.07% YoY, according to beaconcha.in.

The upcoming Pectra upgrade is expected to increase daily active addresses by 30%, which could justify a future $800 billion valuation for Ethereum (VanEck via Forbes).

Actively Validated Services (AVSs) powered by restaking could generate $20 billion in annual fees by 2026, per Bernstein research cited by Forbes.

🔹 Last 30 Days Snapshot (April 2025)

🔐 ETH Staked: 34.2M | Reward Rate: 2.98% (-8.06%)

📈 Staking Ratio: 28.27% (+0.13%) | Staking Market Cap: $63.58B (-2.73%)

💰 DeFi TVL: $101.89B

⛽ Gas (fees): 0.7 – 20.1 gwei | Avg: 7.7 gwei

📉 ETH Price: $1,860 (-2.88%) | ETH/BTC: 11.9%

📌 Sources: Staking Rewards, DefiLlama, beaconcha.in, Forbes, Money in the Sound, Dune Analytics, etherscan.

📬 Stay Connected

✅ Join our Discord

📺 Watch our Cluster Node Tutorial

📰 Read our DVT Deep Dive on Medium

📰 See our presence in LatAm through Ethereum Insight Magazine – Issue 04.

Together, let’s build the future of Ethereum staking—securely, cost-effectively, and decentralised by design.

Stake Smarter with SafeStake.

Source: SafeStake Explorer

SafeStake is a decentralized and pioneering technology company focused on revolutionizing Ethereum staking. With its cutting-edge Distributed Validator Technology (DVT), SafeStake provides an ultra-secure, fault-tolerant environment for Ethereum validators to maximize staking rewards and minimize penalties. SafeStake is committed to driving the growth, innovation, and decentralization of the Ethereum network while ensuring the security and prosperity of its participants.